Tax Revenue Concept

Taxes are compulsory, unrequited payments to general government. They are unrequited in the sense that benefits provided by government to taxpayers are not normally in proportion to their payments. The OECD methodology classifies a tax according to its base: income, profits and capital gains; payroll; property; goods and services; and other taxes. Compulsory social security contributions paid to general government are also treated as taxes, and are classified under a separate heading.

Tax revenue is defined as the revenues collected from taxes on income and profits, social security contributions, taxes levied on goods and services, payroll taxes, taxes on the ownership and transfer of property, and other taxes. Total tax revenue as a percentage of GDP indicates the share of a country's output that is collected by the government through taxes. It can be regarded as one measure of the degree to which the government controls the economy's resources. The tax burden is measured by taking the total tax revenues received as a percentage of GDP. This indicator relates to government as a whole (all government levels) and is measured in USD, USD per capita, percentage of GDP and annual growth rate.

Comparative example

| Spain (2011-2014) | 10 137 | 9 448 | 9 892 | 10 148 |

|---|---|---|---|---|

| Sweden(2011-2014) | 25 348 | 24 338 | 25 842 | 25 121 |

| United Kingdom(2011-2014) | 13 761 | 13 606 | 14 094 | 14 995 |

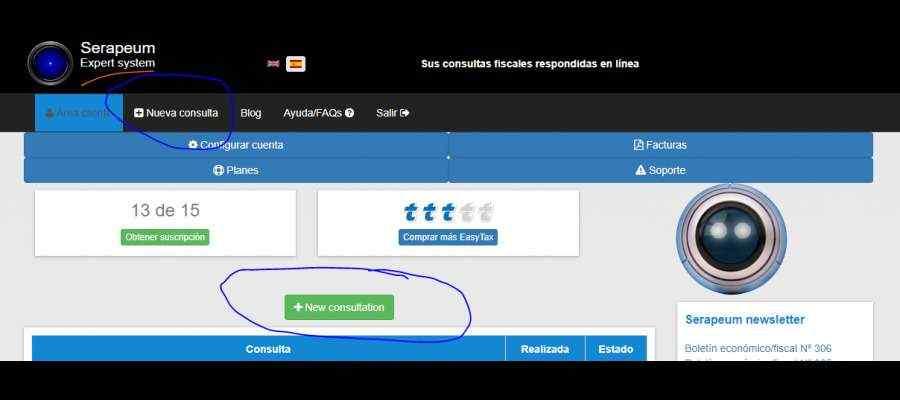

I had a really urgent problem in the middle of the summer that I needed to get fixed. I tried contacting a bunch of agencies but they were either unavailable, slow, had terrible service or were crazy expensive (one company quoted me 1000€!). Josep replied to me within 10 minutes and managed to submit my forms on the deadline and all for a great price. He saved my life - 100% recommend!