In the previous article we referred to the possibilities of artificial intelligence applied to the legal industry. In this we will focus on the possibilities already available to us in the area of taxation.

Artificial intelligence (IA), especially automatic learning, is quickly finding a role in a variety of business functions. One thing I may not have considered is the applicability of AI to taxes. Here are five ways in which AI is reinventing the world of fiscal functions.

1. Automation of routine decisions and reports

One of AI's simplest and most useful applications is the automation of routine tasks, the kind of time-consuming work that can fill a professional's working day. This work involves using automatic learning algorithms that have become commonplace in the business world and in our daily lives. For example, optical character recognition and speech recognition are being adapted to support the fiscal function.

These intelligent algorithms can be put to work to categorize sales in the appropriate jurisdiction to manage sales tax calculations. Or, they can scan and analyze employee expense reports to determine which deductions are available based on the type and amount of each expense. Although the use of machine learning algorithms requires a certain level of thinking, they are not overwhelmingly complex and, in fact, some of these tools can be installed and managed by a typical business or tax professional.

2. Improved dashboards for decision making

Since the dawn of the cloud computing era, the dashboard - which can offer suggested actions based on learning algorithms - has become one of the most indispensable business tools available. While a simple dashboard can give a tax professional a look at that day's revenues and sales tax liabilities, an AI-informed dashboard is more dynamic, allowing a tax professional to use the system not only to evaluate the past, but also to anticipate the future.

Is the tax burden increasing beyond expectations due to an unexpected disparity in regional sales? Is it time to sell an investment for a tax benefit before the rules or market conditions change? AI-enabled dashboards can give tax professionals an instant understanding of these issues at a glance, helping them make decisions.

3. Improved forecasts

AI will also make predictions more accurate and rapid, operating with simplistic modeling techniques (such as basic regressions or linear interpolations) in favour of tactics that can detect trends on an annual, quarterly, monthly or even more frequent basis. These trends can be extracted from corporate data or by analyzing seasonal changes. An intelligent AI algorithm may even be able to observe weather patterns to determine how sales may be affected regionally and the impact it could have on tax burdens.

4. Advanced scenario analysis

What if you could calculate the probability of being audited based on potential sales and expense scenarios for the next year? AI will make this kind of analysis possible - even in common places - by analysing internal tax data and comparing it with the information available on the economy in general.

For example, would moving the company's headquarters to a new jurisdiction increase the chances of an audit? What about changing the legal structure of the business?

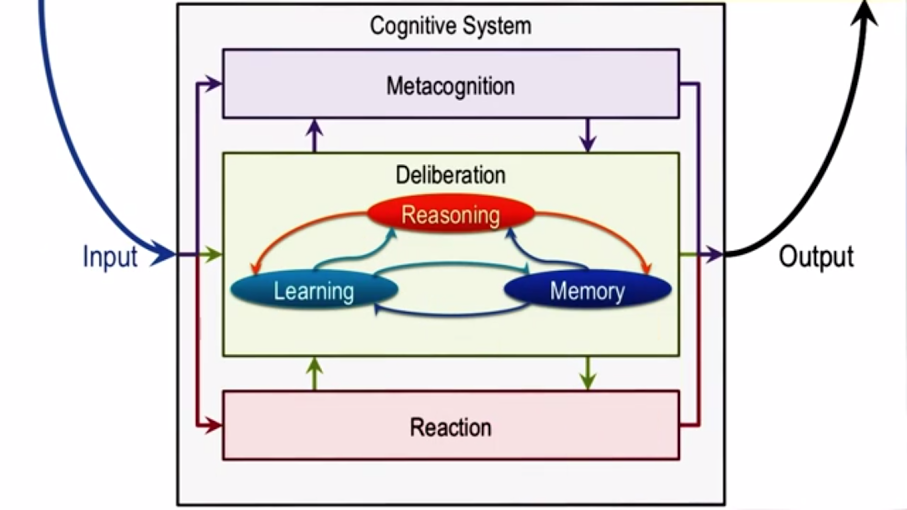

5. Adaptive learning based on operations

At the highest level of AI function, automatic learning will be tested to make (or help with) complex decisions in the absence of any real structured data. For example, instead of your legal team dedicating hours to a 500-page sales contract, an AI tool can do the same work in seconds, determining whether the document contains any thorny legal issues or fiscal risks.

Similarly, an IA system can maintain constant vigilance over the recording of a business's sales actions by making informed decisions about whether the company is at risk of fraud. This type of analysis, when performed by a human being, is often reduced to experience and intuition; a human fraud analyst simply "knows what to look for".

I had a really urgent problem in the middle of the summer that I needed to get fixed. I tried contacting a bunch of agencies but they were either unavailable, slow, had terrible service or were crazy expensive (one company quoted me 1000€!). Josep replied to me within 10 minutes and managed to submit my forms on the deadline and all for a great price. He saved my life - 100% recommend!